The lessons I learned from my first failed startup

Hello, my beloved readers ❤️

Last 8 months, I have been working tirelessly on my first startup, and I have finally reached a point where I feel confident enough to share my journey with all of you. There is nothing easy about starting a business, but it is an incredible experience.

Coming up with the initial idea to finally bring the product to market has been a rollercoaster ride. But through it all, I have learned much about myself and what it takes to be an entrepreneur.

Foreword

About me

I am Bohdan, 25. I worked at startups from pre-seed to series E, as a marketer or growth manager.

I always have the ambition to work on my product and take full responsibility. It's a challenge (a tough one) and that's what attracted me.

Why I wrote this article?

There are a few reasons:

Self-reflection

Startups are about failures, which you could use to learn a lot. Reflecting on failures and successes is critical to learning.

Normalization of failure

Entrepreneurship can be a challenging and uncertain journey, but failure is part of the process. Success stories are often shared, but failures and struggles aren't. I have shared both failures and successes with others throughout my life.

Encouragement and learning for others

Sharing failures can provide encouragement to others who may be facing similar challenges. I would be happy if my failure helped even one person.

To keep it short, I covered only the most significant points without going into too much detail.

Let's move on to the story!

How everything started

I have lived all my life in Ukraine. When the war began, I was fortunate to be on workation in Asia.

Previously, I did not have any plans to migrate, but on 24 February I had to find a new place to live.

Choosing where to live wasn't easy, and I had to consider many things: the climate, the language, the timezone, the environment, safety, the community, and of course, taxes.

And here I found a huge problem.

Taxation is a mess.

Why?

- Fuzzy rules. Rules and regulations are fuzzy and different from country to country.

- Advisory trouble. Quality-time-price problems with advisory services. Different advisers can give you different information. I once paid $1500 for a 15-page report which didn't help much.

- Lack of software. Tax software doesn’t exist in many countries, and existing solutions are inconvenient.

An idea came to mind after I thought it over a lot.

Living in a country means subscribing to certain services and lifestyles. The price of a "subscription" is taxes and living costs.

I came up with a vision: make taxation transparent and client-friendly by digitalizing jurisdictions.

Imagine a global marketplace where you can compare and move between tax regimes, and the paperwork is all automated. It’s a dream.

That’s how Taxarity (taxation + parity) was born.

Ideation and initial research

It felt like I had found a huge problem and I was confident that I could solve it.

In order to pursue an entrepreneurial opportunity, I left Adapty, where I was Head of Growth, while moving to Portugal.

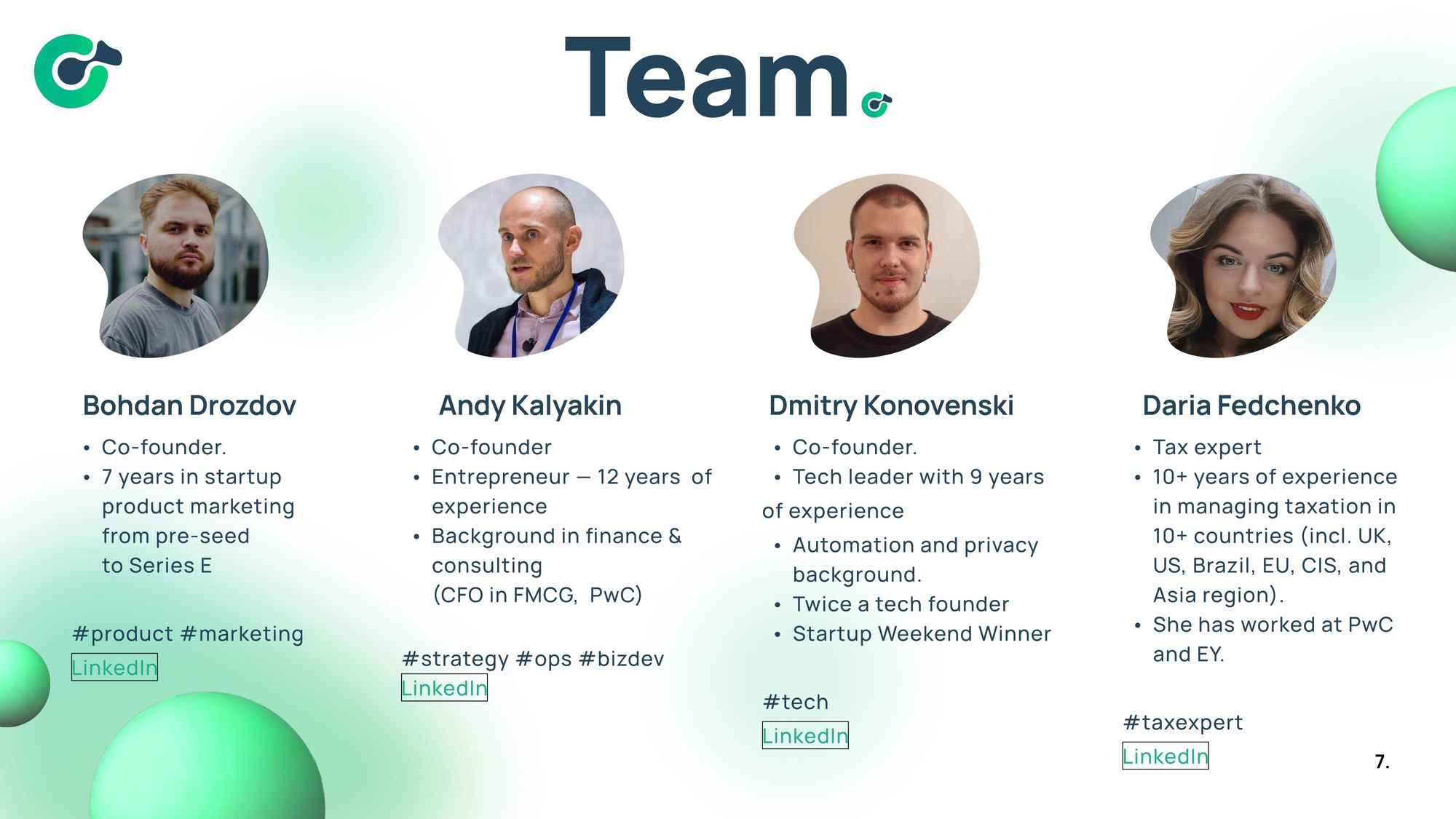

The idea I became obsessed with led me to talk to different people in my network. Andy was one of the first people I spoke with. Andy has been an entrepreneur for the last 12 years. He worked in private equity, PwC, and was CFO of an FMCG company before.

He was open to new opportunities and interested in this idea. So that's how I met my first co-founder.

Great start. Woooh.

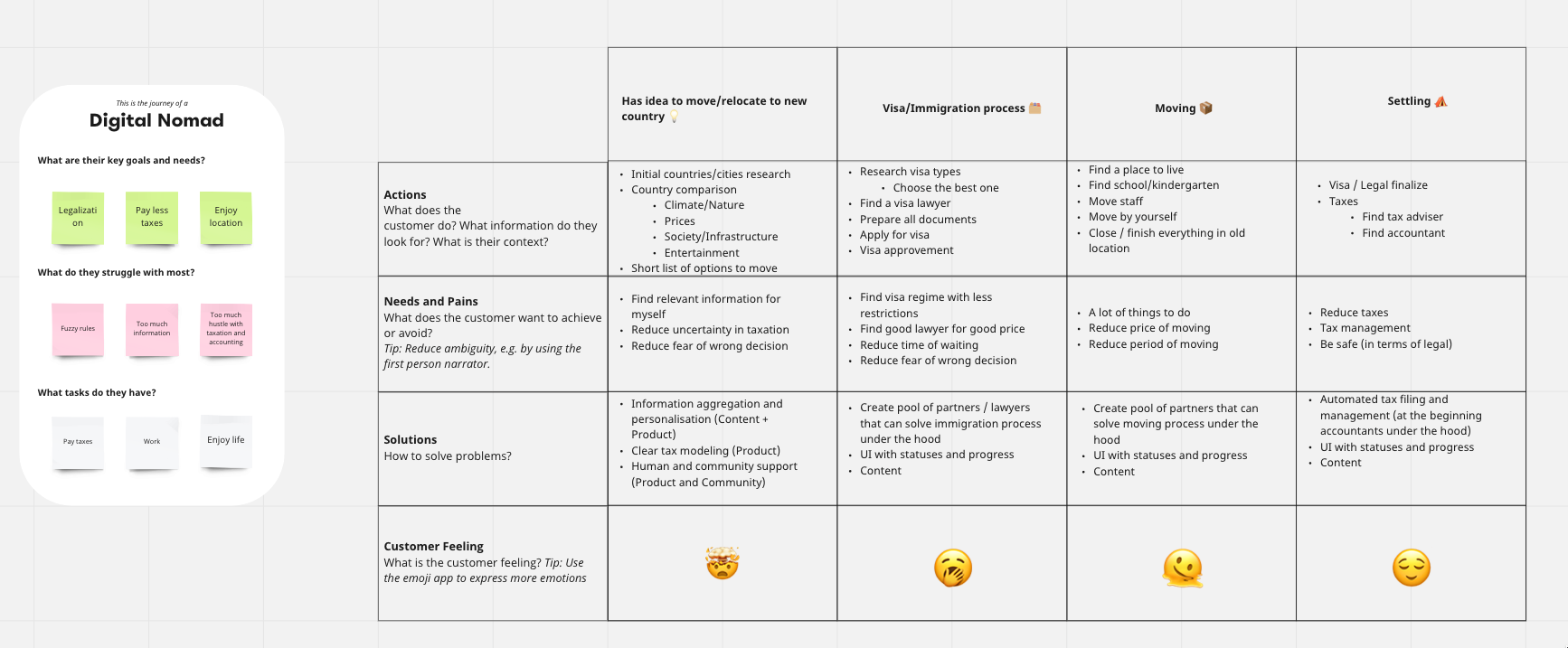

Taxarity was started in June 2022, and we spent the following months interviewing customers and exploring individual taxation. During that time, we conducted more than 50 interviews. We interviewed digital nomads and expats about how they selected countries for their lives and their relations with taxation.

Everybody was stressed about taxation and wanted to get rid of this headache. It was a good sign for us.

We stuck to the idea of tax regime comparison and country choice. It was a mistake, but we will talk about it later.

Neither Andy nor I are engineers.

I asked one of my best friends to join the company as CTO. Since we had previously worked together on a couple of startup ideas, I thought he would be a great fit

However, he refused to agree because he was not interested. First hard-to-swallow pill.

Product building

I loved to think about the future of Taxarity, how we will grow, how we will build a community around the product, and how we will hire. Who will acquire us.

I dreamed.

Of course, it didn’t help to move the needle.

We rolled up our sleeves and decided to work on MVP. But where to start? The problem of taxation and immigration is pretty complex.

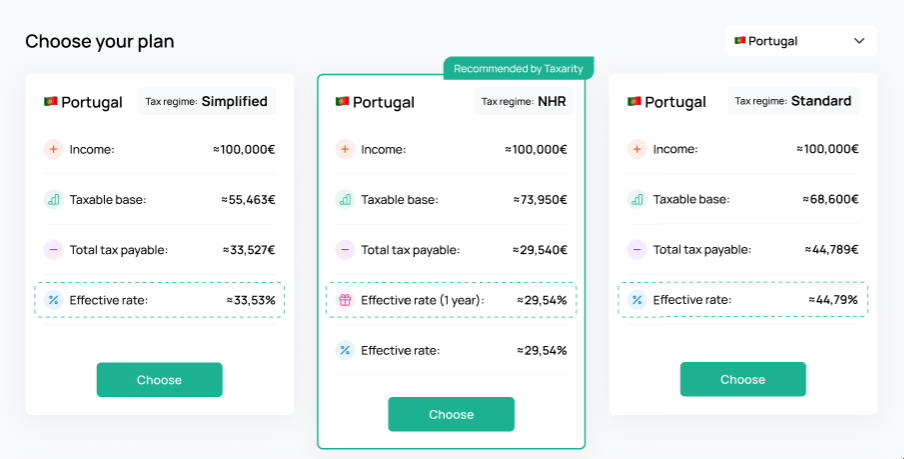

We decided to focus on efficient tax rate calculation and tax regime comparison.

In my network, I found people who work at EY and help companies and some individuals optimize taxes.

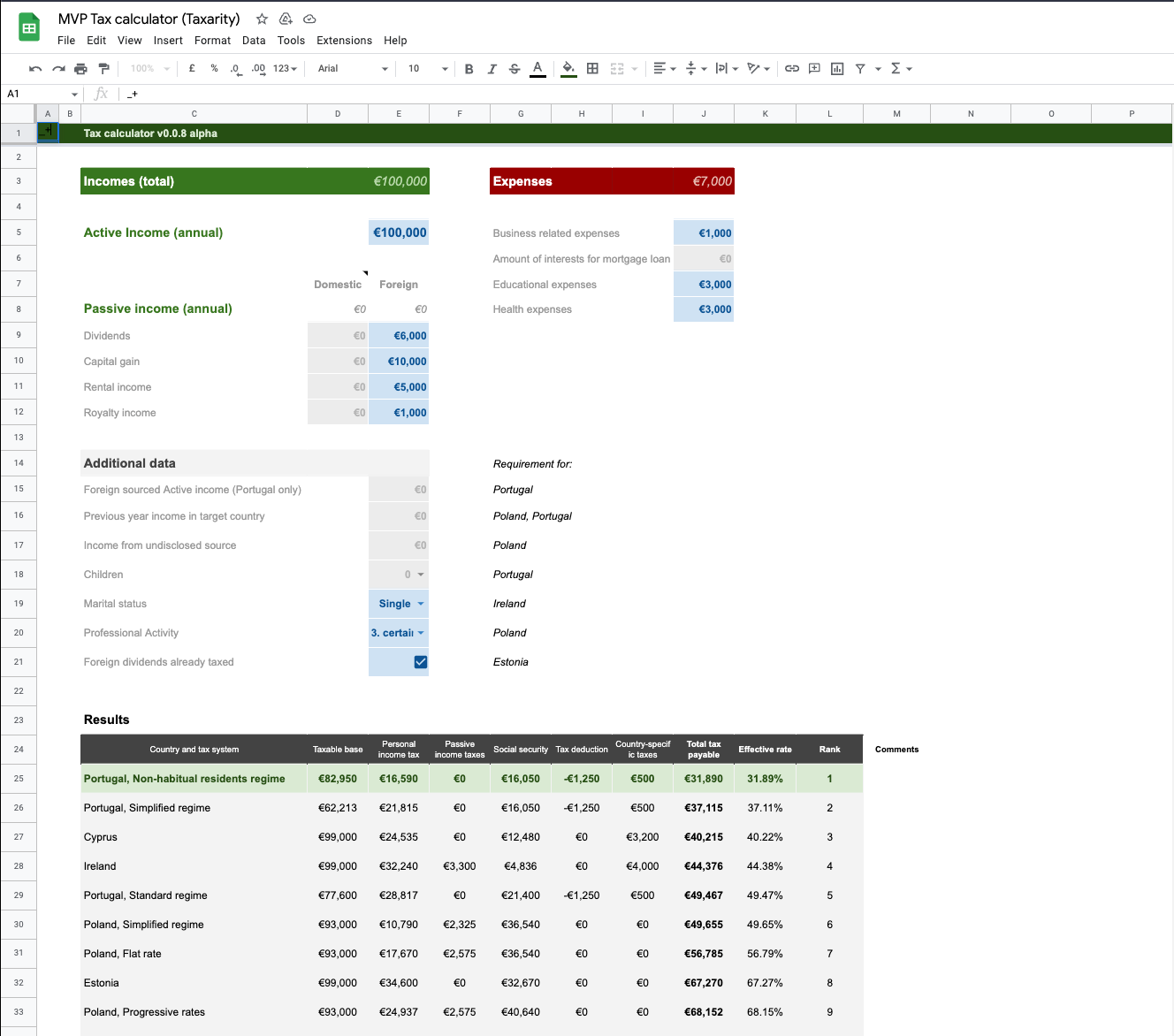

We decided to be lean and build this model in Google Sheets. By design, it would be easy to add the next countries and then move it from Google sheets to the backend.

Oh, that wasn't easy at all. We picked five European countries and structured all tax brackets into tax regimes that are suitable for remote tech workers. But we did it!

Fundraising

We decided in August that the development of a proper product would require funding. Before fundraising, I covered all expenses with personal savings. It was not easy, but I was bullish on Taxarity.

Working on a pitch deck helped us a lot because it helped us organize all our thoughts and ideas into simple slides.

We initially planned to raise $320k pre-seed within 3-6 months with our MVP and use this money to develop the product, cover personal expenses, and test the first marketing hypotheses. Then raise a seed round in 12 months. Seems feasible (aha).

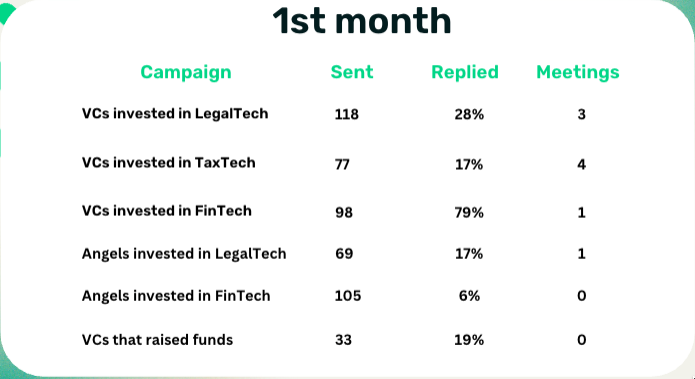

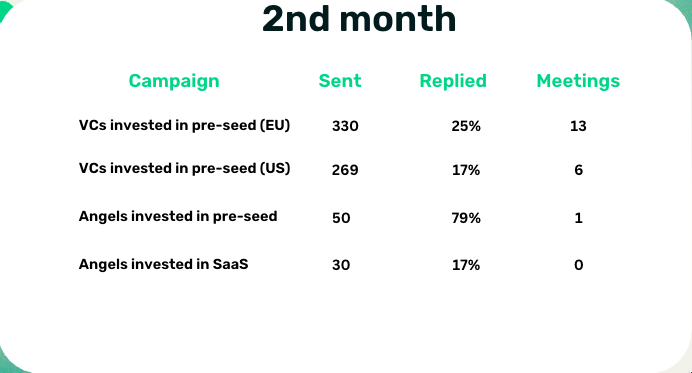

This was my first fundraising event, so we had to organize a cold outreach process. The potential investors were divided into segments and tested as hypotheses.

We prepared a pitch deck, warmed up emails, and sourced and clean all contacts.

The first deck and pitch were awful.

After a lot of iterations and feedback, we formed storytelling, product vision, and market.

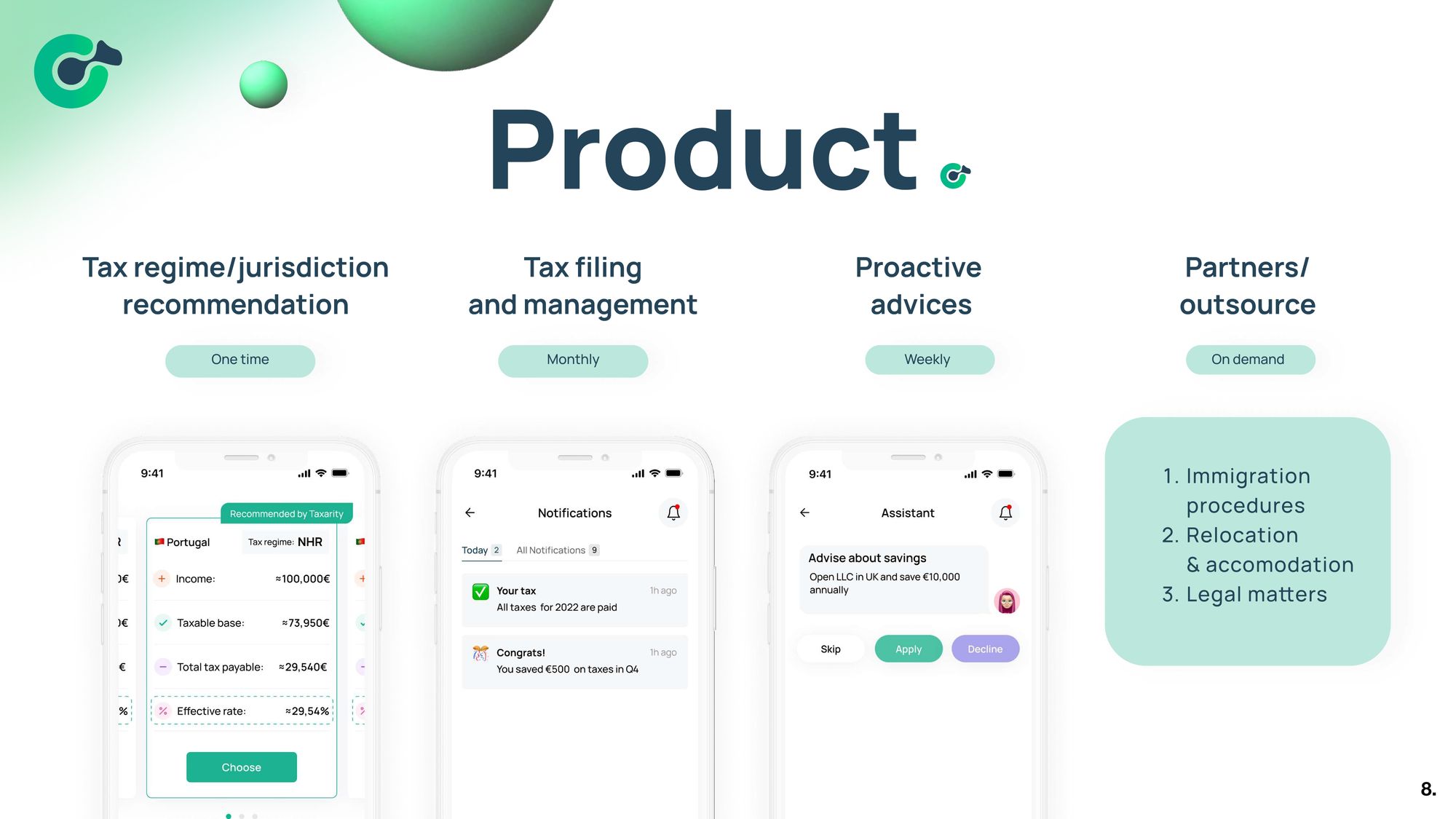

Taxarity is tax management software for digital nomads.

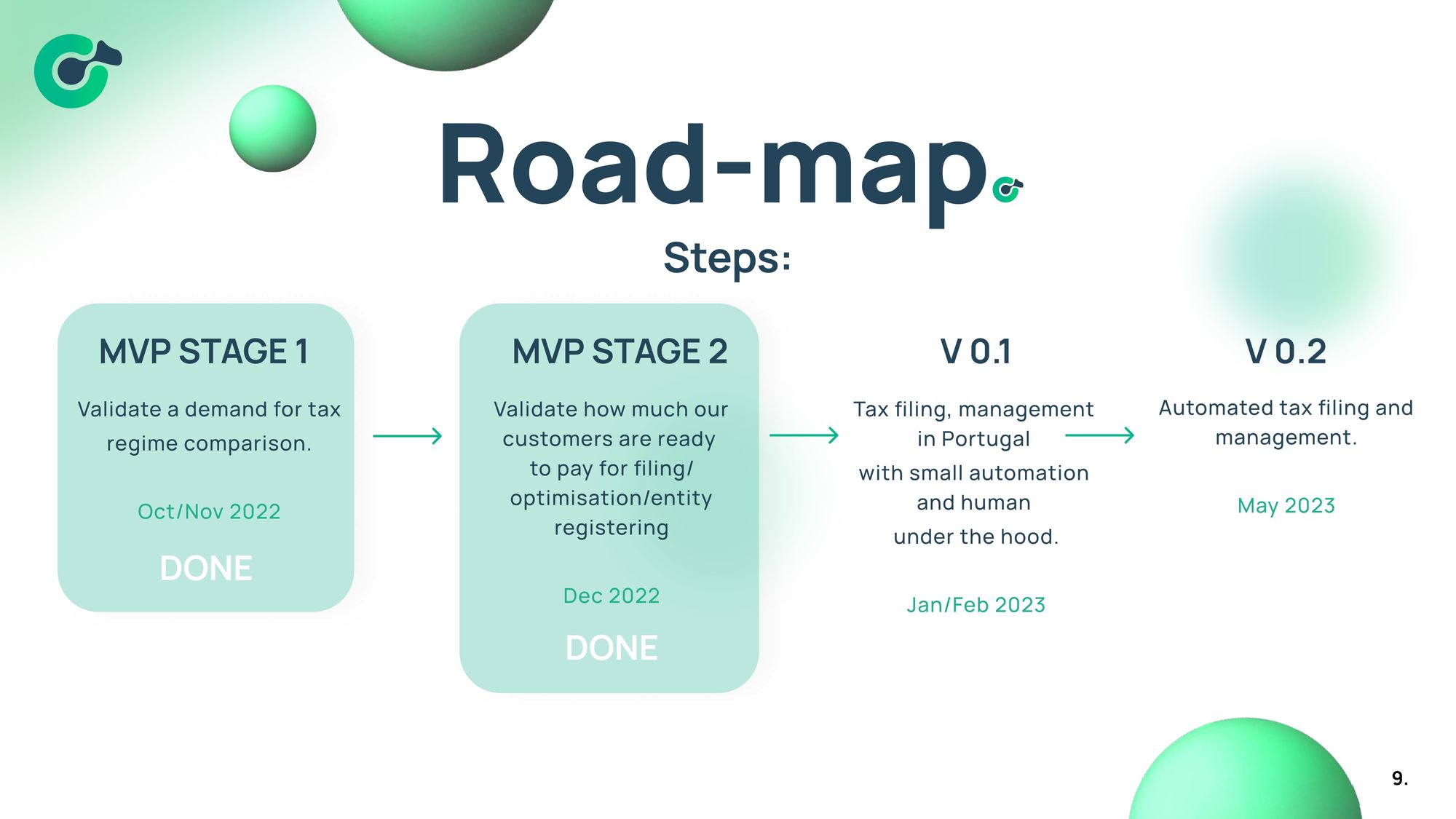

Our pitch-deck

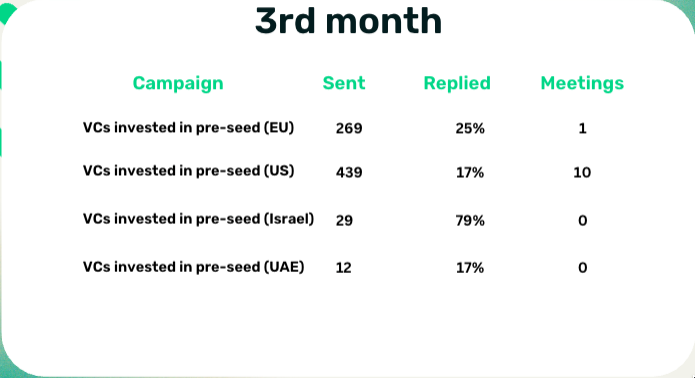

Cold outreach stats

Cold shower

We realized, after two months of fundraising, that investors didn't believe in us. We were accepted into three incubators but without funding.

A fragmented market and solution complexity were some of the concerns raised by investors.

For some investors, it was too early to invest and they needed traction.

The most important thing was realizing we were focusing on the wrong part of the customer journey and that we needed to focus on tax filing and management in a particular country. Then add countries one by one.

At that point in time, I was already exhausted. In the autumn I had three panic attacks, more than ever before. Managing all the stress and uncertainty was challenging for me.

But I didn’t give up.

Last push

All the time, I was passively looking for a CTO. Some of the engineers in my network weren't interested, and some were in forced immigration and didn't want to leave their stable jobs.

But there was one exception. Dumi. One of my former colleagues from Aura. An ambitious tech lead with a failed startup in the past, tired of working at the company he currently works for.

Sounds great? It was.

We offered him to be co-founder & CTO. We agreed that he could help us part-time and then join us full-time after fundraising.

It wasn't perfect, but we had no other choice.

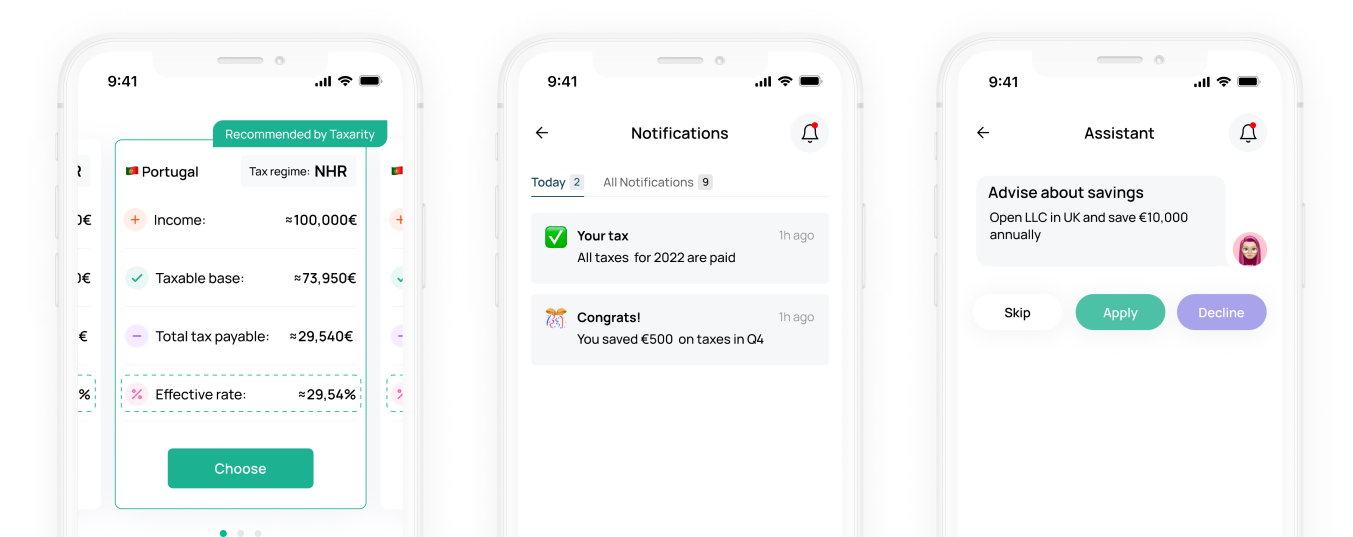

I put a “Product Manager” hat on myself, found and hired a product designer, and started to work on a tax management app for digital nomads in Portugal.

Next month and a half, we pitched to new investors and worked on the product's first version. Slowly, with baby steps.

On one Monday, after 1.5 months, Dumi told us that he had changed his mind and he would help us release the first product, but we needed to find a new CTO. Why? He told us he understood that he was not ready to be CTO.

F*CK

Shutting down

We continued to work on Taxarity over the next few weeks.

We also started an incubation program in a local incubator. It was cool. I met a lot of entrepreneurs that decided to work on their own ideas and products.

Released the first product.

But...

My sleep was ruined. I was always in a bad mood. I lost hope.

In order to continue working on Taxarity and achieve traction that might attract investors, I would need to spend more than $10k. I didn't have such an amount after 8 months of bootstrapping and relocation to a new country.

I started to feel the first signs of depression. After two in the past, it was scary.

I decided to give up.

What went wrong?

1) Focus on the wrong part of the customer journey

We spent too much time focusing on the wrong part of the digital nomad journey. We worked on tax regime comparisons for a few months, but this "job" is not recurring. Furthermore, such a product would be difficult to monetize.

The time to value is also too high. It takes a lot of effort and time to move to a country, settle down, and become a tax resident after choosing a country.

Why did we focus on this part?

We were biased, because of our social bubble (Ukrainians choosing a country to settle down)

- It seemed closer to the vision of a “tax regime marketplace” and it was easier to think about this future.

- Because of my experience in marketing and growth, I was biased. My focus was on the future instead of providing an immediate solution to the problem.

Takeaways

- Write down and map the customer journey ASAP. Focus on the parts and problems that are recurring and have a shorter time to value.

- Control your ego. Due to my ego and self-confidence, I was too optimistic about a lot of things. I paid a big price for this lesson.

2) A long cycle of iterations

We worked on some hypotheses for too long. We were "lean" in terms of spending on Taxarity. I was burning more money on my own life with long iterations. Long iterations also increase "time to market".

Takeaways

- Calculate the company burn rate as well as your personal burn rate.

- Make hard deadlines and stick to them.

- Iterate more quickly.

3) Disbalance in founders team

Choosing the right co-founder is important for several reasons:

- Complementary Skills: A co-founder can bring skills, experiences, and perspectives to the table that you don’t have. This can help fill gaps in your skill set and increase the team's overall capabilities.

- Shared Vision: A co-founder who shares your vision and passion for the business can provide the motivation and drive needed to make it a success.

- Balance: Starting a business can be challenging, and having a co-founder can help balance the workload and provide emotional support during tough times.

- Improved Decision-Making: Having a co-founder can lead to better decision-making as you can bounce ideas off each other and arrive at decisions together.

- Reduced Risk: Starting a business is risky, but having a co-founder can help mitigate some of that risk by providing a second person who is invested in the success of the business.

My chemistry with Andy was great. We enjoyed working together and supported each other. But we are more salespeople than builders.

Dumi was a builder but wasn't ready to jump into our venture, as we discovered later.

- Establish networks with mature engineers who may become tech co-founders.

- Align with potential co-founders about readiness and willingness to risks.

4) Timing

My work on Taxarity began during forced migration. My home country is in the middle of a war. Starting a company is hard, and for me, it was an escape from reality.

Constant bad news caused me a lot of stress. The process of socializing and settling down in a new country can also be challenging.

Additionally, there is a huge global crisis. Investors were more skeptical, especially in the early stages.

Because I was in love with the Taxarity vision, I underestimated the things above.

Takeaways

Before starting, ask yourself:

- Am I ready mentally and physically to work on my startup?

- What would you be excited to work on for the next 5-7 years?

- Am I escaping from some problem in life by focusing on this idea?

- Changes in your life and around will help you or vice versa?

5) Domain expertise

Before Taxarity, how much did I know about taxes? The bare minimum.

We talked a lot with lawyers, tax advisers, and accountants in order to build a product.

Different specialists can provide different information due to messy rules, so we found our own way to handle this.

At the beginning, we wanted to partner with a law firm that could help us with all the legal stuff.

We spent a few months on this. All of them are super slow and inefficient.

Finally, we hired a local accountant and also found an international expert to assist with strategic questions.

Takeaways

- Find a way to get missing domain expertise in a fast way ASAP

- Align on terms, interests, and commitments with experts/advisers/partners at the beginning

What is next?

My attempt at founding a startup failed, but I don't regret it. I know it wasn't the last attempt. Perhaps I'll find a job to earn money and cover my expenses, and I will think about the next ideas.

Stay tuned!