Quick reminder if you’re new here: I’m Bo, and I’m building SavvyNomad, a SaaS tax-tech startup helping Americans who live abroad reduce their U.S. taxes through domicile service in states with no income tax.

May was surprisingly even slightly better in terms of revenue than April. I expected lower results because April benefited significantly from the tax filing deadline, driving an all-time high in organic traffic and demand.

Instead, we managed to add almost the same number of new customers as in previous months. Revenue increased mainly because more subscribers opted for our new premium-priced plan, boosting our average revenue per user (ARPU).

However, not everything went smoothly this month. While we are still riding the residual wave of tax season interest, we saw a significant drop in organic traffic in May. Additionally, we faced nearly two weeks of subscription and marketing attribution issues. Although we managed to fix these issues, we lost some valuable data during this period.

In addition, we also received a substantial amount of low-quality traffic from the Philippines and Indonesia due to a Google Ads bug, which inflates some of our non-revenue metrics.

On a brighter note, May marked the launch of our first YouTube video, and we plan to continue pushing into this promising new channel.

Here’s the detailed breakdown:

Key metrics

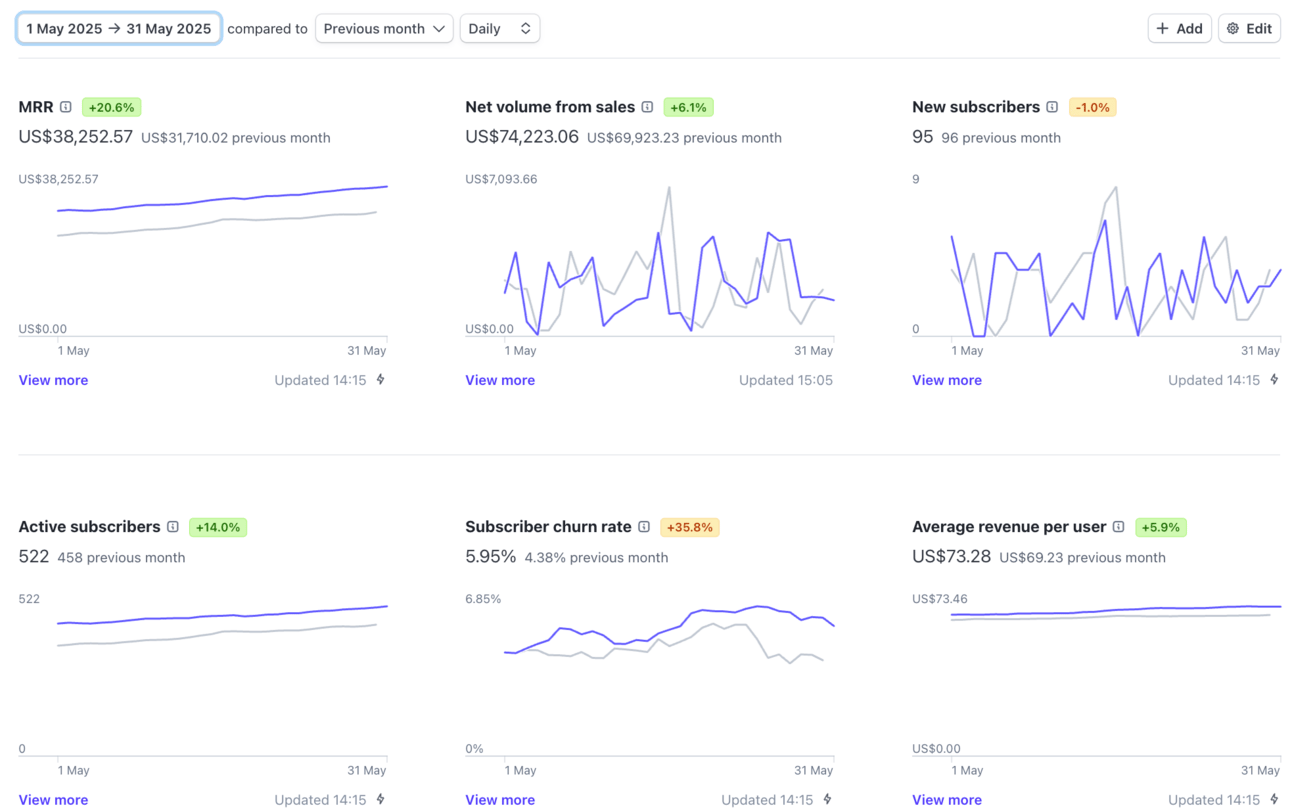

We made progress across most metrics this month, but our website visits and conversion rates were inflated due to low-quality traffic from a Google Ads bug. I’ll provide more context about this in the Google Ads section below.

Additionally, our churn rate has slightly increased. I’ve started thinking about how we can tackle this issue—I’ll share more about these ideas in the Plans for June chapter.

Metrics | April | May | % Change |

|---|---|---|---|

Signups | 1,374 | 2,063 | +50.1% |

Website visits | 26,000 | 36,000 | +38.5% |

Visit → Signup CR | 5.3% | 5.7% | +7.5% |

Signup → Customer CR | 7% | 4.6% | -34.3% |

Added MRR | $6,480 | $6,542 | +1.0% |

Total MRR | $31,770 (38% of $1M ARR) | $38,252 (47% of $1M ARR) | +20.4% |

Active subscribers | 457 | 522 | +14.2% |

New subscribers | 96 | 95 | -1.0% |

Churn rate | 4.38% | 5.95% | +35.8% |

ARPU | $69.23 | $73.28 | +5.9% |

Where did new customers come from?

May was tricky in terms of marketing attribution. Due to recent changes in Google Analytics, we had attribution problems for about 10 days, leaving us with some unattributed customers.

This month brought a notable shift: we acquired more customers from Google Ads than from Google Organic traffic—a first-time occurrence for us.

Another exciting development: We attributed our first two customers to ChatGPT, clearly showing that large language models (LLMs) like ChatGPT are increasingly influencing user discovery. We’ve also observed that AI-driven search from tools like ChatGPT is beginning to cut into traditional organic search traffic.

Additionally, intro call attribution revealed that around 10% of all intro calls explicitly mentioned discovering us via ChatGPT or other AI tools, signaling an important new channel for customer acquisition.

Now, let’s examine each marketing channel, our activities, and the key lessons from this month.

Organic traffic

This month brought many changes to our SEO and organic strategy. We continue investing around $3,500 a month in link building, and I’ve continued writing new, optimized articles.

These efforts helped us achieve a significant Domain Rating increase—from DR 25 to DR 35, according to Ahrefs—which is good progress despite being just one metric among many.

Google Search Organic

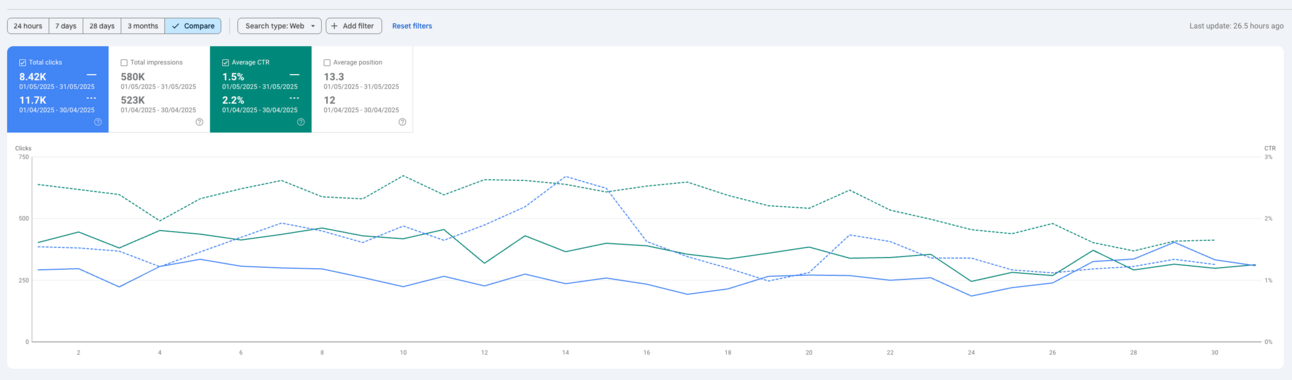

May was a wild ride, especially given Google’s anticipated announcement of rolling out AI-generated search results and AI overviews across numerous search queries. As a result, we saw a notable 22% drop in Google organic traffic.

However, I believe the decline is primarily due to slightly lower seasonal demand than in April, which experienced record-high activity due to tax deadlines. May’s traffic still beat our March figures.

Our Google Search Console data (see screenshot) shows that our CTR dropped even though impressions increased slightly. While this isn’t ideal, it’s far better than some founders experienced this month—I’ve heard stories of 60-80% traffic losses.

Google remains one of our main acquisition channels, and we’re continuing the fight. Still, diversifying is crucial, especially given Google’s AI-driven changes. This uncertainty motivated us to invest in video content and YouTube, which Google doesn’t seem to threaten anytime soon. We plan to leverage existing Google Search traffic to kickstart our YouTube channel growth.

I'd like to know more about this strategy in the YouTube section.

Bing

Bing organic traffic also saw a slight drop (19% decrease), likely again due to decreased seasonality compared to the high-demand tax season. Bing hasn’t announced any dramatic changes, so we assume this dip is primarily seasonal and a normal fluctuation.

Free tool launch

This month, we also launched our first free tool to attract backlinks and organic traffic—a tax calculator for U.S. expats. We hope this tool provides genuine value to our target audience and attracts backlinks organically.

We’re already working on another calculator, and over the next few months, I’ll share updates about the effectiveness of these tools, including the number of backlinks and traffic they’ve generated.

Next, let’s unpack how our paid channels performed this month.

Google Ads

This month was mixed for our Google Ads performance.

On the positive side, it was the first month we redistributed our budget based on a detailed customer acquisition cost (CAC) analysis. In April, we connected Google Ads campaign data directly to subscriptions, giving us valuable insights.

It was both exciting and a bit disappointing because we learned where our highest-converting spend was happening, and we discovered we’d wasted significant funds on campaigns that didn’t convert into customers.

During a call with our Google Ads manager, I learned about a compelling targeting feature in Performance Max campaigns—the ability to target visitors to competitor websites directly. We tested this and achieved promising results: three new subscriptions at around $15 per customer, an incredibly low CAC.

While I understand this kind of CAC probably won’t scale significantly, the results are encouraging enough for us to expand the experiment next month. We plan to produce targeted video ads to boost effectiveness and conversions further.

On the negative side, our remarketing campaign with display ads delivered a large volume of low-quality traffic from the Philippines and Indonesia. Initially, I suspected a campaign setup mistake, as similar things have happened before.

However, our Google Ads manager reviewed my settings in a follow-up call and confirmed everything was correctly configured. He identified it as a bug and escalated it to Google’s internal team for further investigation.

Due to this issue, some metrics such as website visits and signups are inflated for May, and consequently, our overall conversion rate from signup to subscription appears lower than normal.

Youtube

This month marked a significant milestone—we published our first YouTube video based on one of our most popular articles. I’m very happy with the quality; it turned out great, especially for a first attempt.

However, the production took much longer than expected, nearly an entire month, primarily due to bottlenecks in video editing. We initially agreed with our video editor to produce one video per week. Still, unfortunately, he couldn’t keep up with this pace, even though we’re capable of shooting 1–2 videos per week.

Given how quickly Google search is evolving, diversifying acquisition channels is becoming increasingly important. Speed and volume in YouTube content production are critical for us. I’ve started experimenting with three additional video editors to solve this editing bottleneck.

Currently, producing a YouTube video costs us around $500 per video, covering scriptwriting, filming, editing, and thumbnails. This is a reasonable price that meets our quality standards. I’m still involved in production mainly to maintain quality control and consistency. My previous experience with my personal YouTube channel helps significantly, especially with details like script improvements, video structure, and thumbnails.

Our immediate goal is to publish at least one video per week consistently, and I’m hopeful we can release at least three videos in June. Additionally, we’re considering experimenting with shorter video formats to boost engagement and channel visibility, though our current focus remains on long-form content.

I’ll shoot some videos on content strategy, primarily on topics like immigration, residency, and other related subjects. For tax-specific content, we’ve decided it’s more trustworthy if presented by an American speaker rather than a Ukrainian dude with an accent. This approach helps reinforce credibility with our U.S. audience while still allowing us to expand our content coverage and audience reach.

Personal updates

May was my final month in Brazil, and I spent it exploring several breathtaking locations. I visited Lençóis Maranhenses National Park, famous for its incredible dunes and lagoons—truly a magical landscape.

Next up, I fulfilled a childhood dream by spending three days in the Amazon Forest. This adventure was incredibly exciting and deeply rewarding for me. I enjoyed every moment, soaking in the vibrant sounds, sights, and biodiversity of the Amazon.

To capture this unforgettable experience, I made a short video—you can enjoy it:

Plans for June

In June, we’ll continue actively improving our website. We’ll refresh existing pages and add new product pages, incorporating feedback we’ve collected from current and potential customers, as well as insights from heatmaps and analytics. Given that our website hasn’t seen significant updates for around 3–6 months, now feels like the perfect time to enhance its usability and content clarity.

Additionally, we’ve recently explored potential expansion opportunities. I’m hopeful we’ll begin launching complementary products to serve our existing customers better, as well as new products aimed at our broader target audience. I’ll share more updates as we progress.

YouTube will remain a priority. Our goal is to maintain a consistent pace of at least one high-quality video per week, accelerating our content output and further diversifying our acquisition channels.

I also plan to experiment further with Google Ads Performance Max campaigns, particularly by introducing more video advertisements. Improving our analytics and attribution accuracy is another key focus, as clearer data will enable better advertising decisions and increased efficiency in marketing spend.

Finally, I’ll start investigating our increasing churn rate. We need to understand whether rising churn is simply due to attracting more “cold” customers or indicative of deeper product issues. Although churn remains within our manageable range (5–10%), identifying actionable insights will help us enhance retention in the long term. While this isn’t our highest priority given other ongoing initiatives, it will still receive careful attention.

On a personal note, June marks the end of my Latin America chapter, where I’ve spent an amazing full year exploring and working remotely. From June through August, I’ll be in the United States, starting with a month in San Francisco. If you’re around, I’d love to connect! And if you know any cool or inspiring people you think I should meet while I’m there, please let me know.

Thanks for reading, and see you in the next one:)